Mergers and Acquisitions Firm in UAE. Expert Legal Guidance for Seamless Transactions

Get expert M&A advisory and consulting services in the UAE. SK Legal is one of the top mergers and acquisitions firm in UAE that provides strategic guidance, due diligence, and legal support to ensure smooth transactions for businesses across industries.

Mergers & Acquisitions (M&A) Legal Services in UAE

A merger or acquisition can be a pivotal moment for your business. Without expert legal guidance, you risk incurring regulatory fines, uncovering hidden liabilities, and agreeing to unfair contract terms. At SK Legal, we ensure that your M&A transaction is meticulously structured, risk-free, and legally sound, offering you peace of mind and confidence in your decision.

Need M&A Legal Expertise? Get in touch today.

What Are Mergers and Acquisitions?

Mergers and Acquisitions (M&A) involve strategic consolidation of businesses, either by combining two companies into a single entity (merger) or one company purchasing another (acquisition). These transactions are typically pursued to expand market presence, gain competitive advantages, improve operational efficiency, or boost profitability. M&A deals can be friendly or hostile, depending on whether both parties consent to the transaction.

Companies undertake M&A for various strategic reasons, including diversification, achieving cost synergies, expanding market presence, and accessing new technologies or talent. However, these transactions involve intricate legal, financial, and regulatory complexities, making expert legal advice crucial for ensuring a seamless and compliant integration process.

What’s the Difference Between a Merger and an Acquisition?

Although the terms “Mergers” and “Acquisitions” are often used interchangeably, they refer to separate processes with different implications for the entities involved.

Merger

A merger takes place when two companies join forces to create a new organization. During this process, both companies legally dissolve their former identities and establish a new entity, usually under a different name. The aim is to leverage combined resources and expertise to create a more robust and competitive business. For example, Company A and Company B merge to form a new Company C.

Acquisition

An acquisition, in contrast, refers to one company buying a controlling stake in another. In this scenario, the acquiring company assumes control over the target company’s operations, which may no longer operate as an independent entity.

Acquisitions can be friendly or hostile. Friendly acquisitions occur when both companies mutually agree to the terms of the deal, often resulting in a smooth integration process. On the other hand, hostile acquisitions happen without the consent of the target company’s board, typically involving a more contentious process.

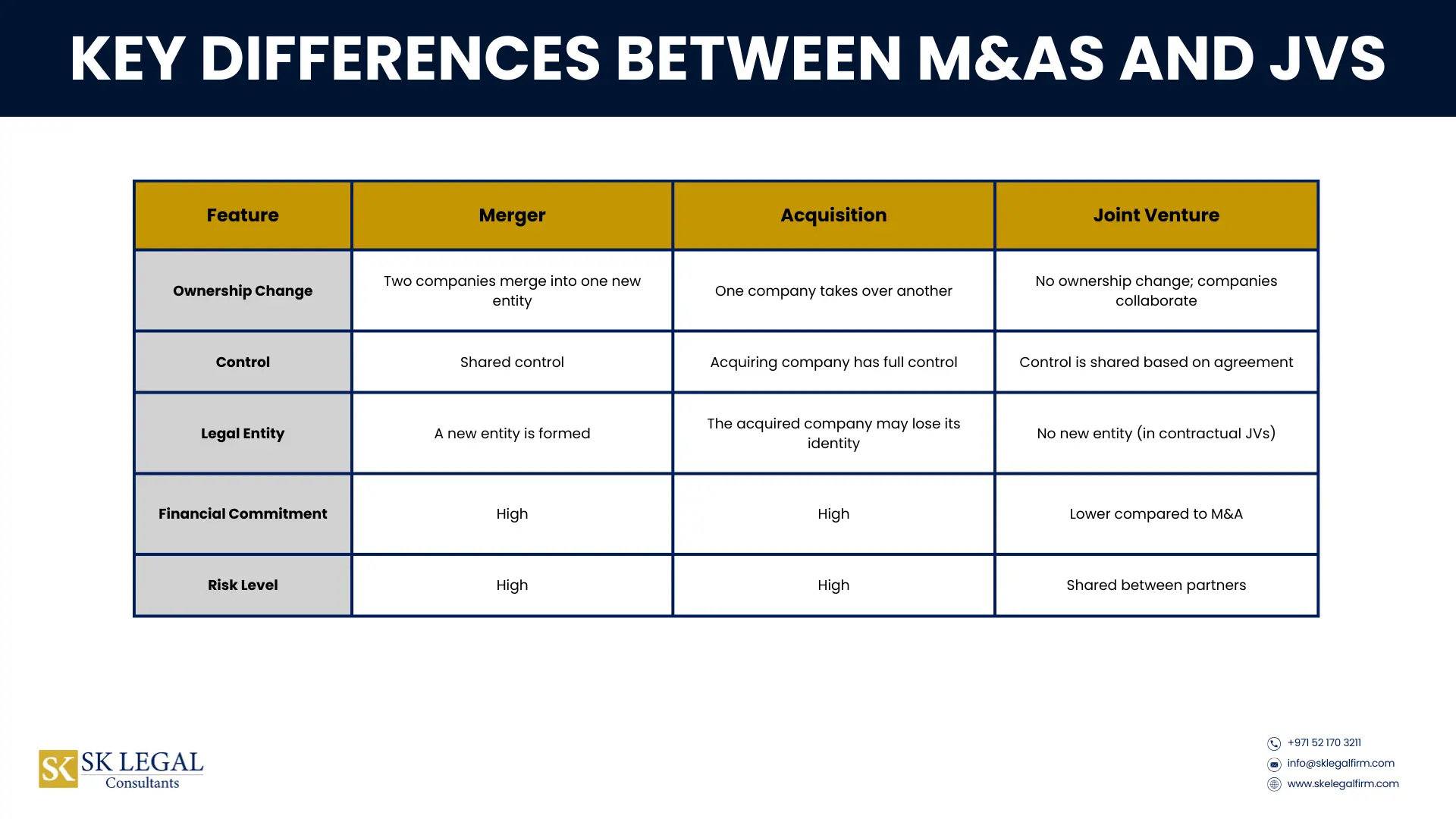

Difference Between Merger, Acquisition, and Joint Venture

|

FEATURE |

MERGER |

ACQUISTION |

JOINT VENTURE |

|---|---|---|---|

|

DEFINITION |

Two companies combine to form a new entity |

One company takes over another |

Two companies sign a joint venture agreement to work together for a specific project |

|

OWNERSHIP |

Shared ownership |

One company gains control |

Both companies retain their independence but are jointly and severally liable to the client for whom they are executing the project |

|

LEGAL INDENTITY |

A new company is formed |

Acquired company may be |

No separate legal entity is created |

|

CONTROL |

Equal partnership or proportional |

Acquirer gains decision-making power |

Decision-making is typically shared as per the terms of the joint venture agreement |

Which One is Right For Your Business?

Both joint ventures and mergers & acquisitions serve as strategic tools for business expansion, yet they operate in distinct ways.

A joint venture involves a collaborative partnership where two or more companies combine their resources for a specific project, enabling businesses to access new markets and broaden their offerings. Joint ventures are typically formed to achieve a specific goal or project, with partners working together to capitalize on each other’s strengths and resources for mutual benefit. The flexibility of joint ventures is rooted in their temporary nature and straightforward exit options, which avoid long-term obligations.

In contrast, mergers & acquisitions involve integrating companies into a single entity or acquiring another company, leading to potential cost savings and enhanced market presence. While M&A offers greater control, it requires significant operational integration and can be legally and financially complex. M&A deals often have diverse objectives, such as acquiring assets, increasing market share, achieving cost synergies, or expanding product lines, and typically involve long-term integration strategies.

Each structure has its own legal, financial, and strategic implications. Therefore, it is important to seek expert advice to ensure you choose the best approach for your business goals.

What Are the Benefits of Mergers and Acquisitions (M&A)?

Mergers and acquisitions offer several advantages for businesses looking to expand, compete, or innovate in their industry. However, M&A transactions also involve risks, such as cultural clashes, integration challenges, and regulatory hurdles. Proper M&A legal and financial planning ensures a successful transition. Some key benefits of M&A include:

Market Expansion & Increased Market Share

Gain a competitive edge by entering new markets or increasing market dominance.

Cost Synergies & Operational Efficiency

Reduce costs by eliminating redundancies, sharing technology, and streamlining processes.

Access to New Talent & Expertise

Bring in specialized knowledge, skilled employees, and leadership.

Diversification & Risk Reduction

Reduce reliance on a single market, product, or service by expanding offerings.

Increased Financial Strength & Investor Appeal

Larger businesses typically have greater financial stability, creditworthiness, and access to capital.

Enhanced Innovation & Technology Integration

Access new technologies, patents, and intellectual property for growth.

Types of Mergers and Acquisitions (M&A)

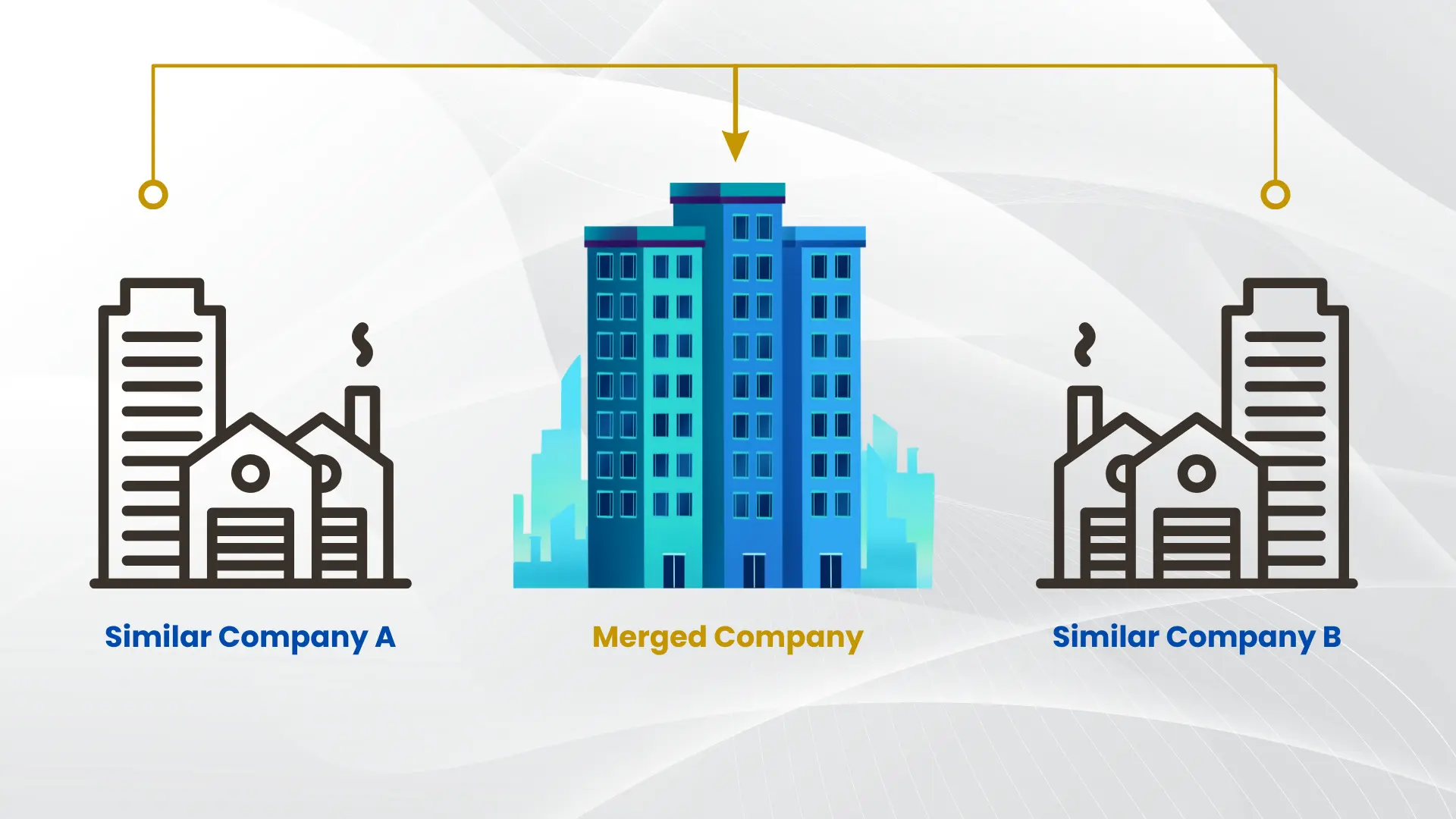

Horizontal Merger

A horizontal M&A transaction takes place when companies within the same industry come together or when one company acquires another operating in a similar sector.

Horizontal transactions typically involve companies producing related products or providing similar services as direct competitors. For example, merger of two rival restaurants or airlines.

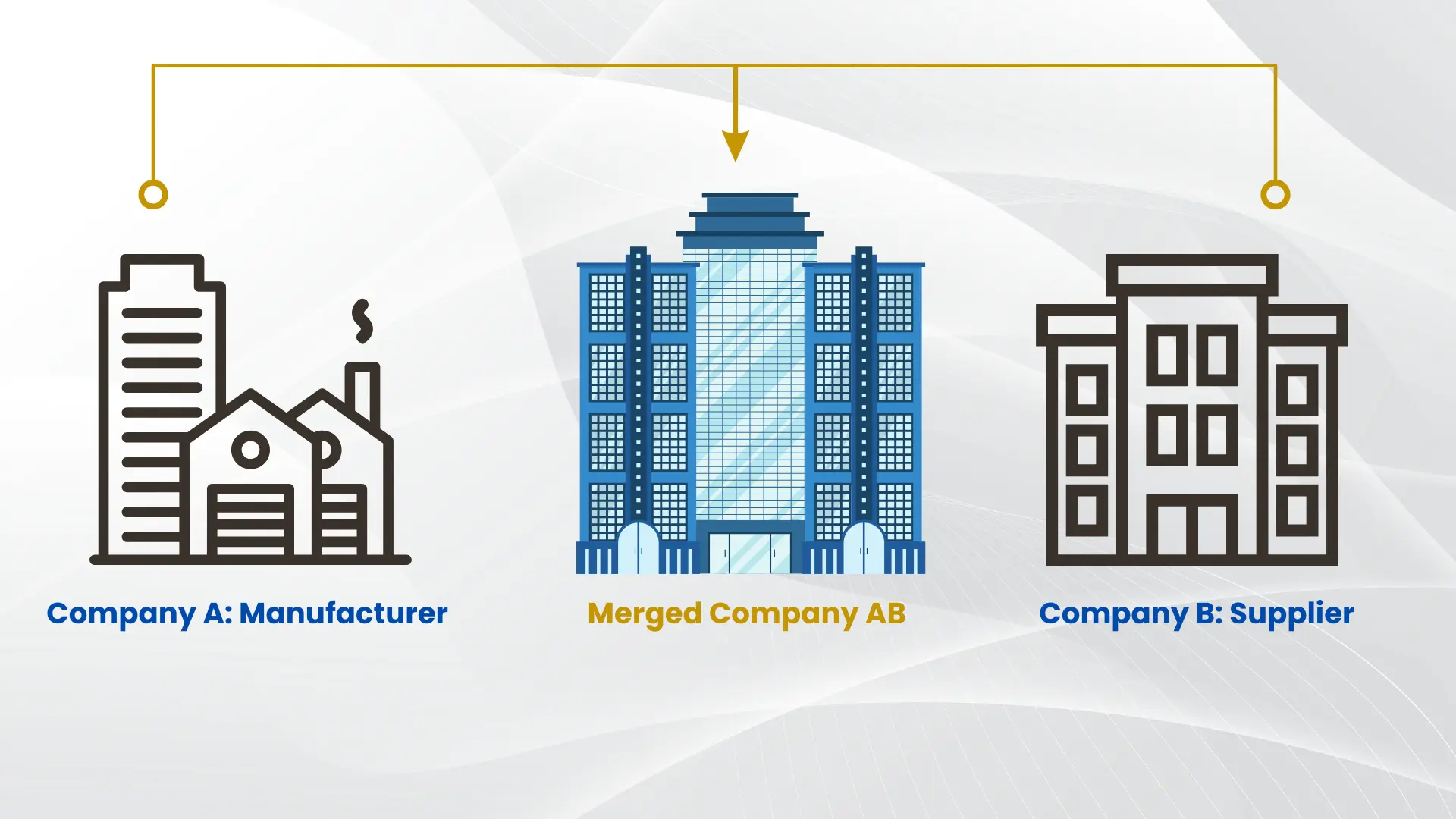

Vertical Merger

Vertical arrangements connect businesses operating at different stages of the supply chain. Vertical transactions typically involve companies that are not in direct competition with one another. For example, a car manufacturer merging with a parts supplier.

Conglomerate Merger

A conglomerate M&A transaction occurs when two companies from entirely different industries combine their operations. This type of transaction enables the newly formed company to broaden its portfolio and revenue streams. For example, an FMCG company merging with a software firm.

Market Extension Merger

A market extension merger involves two companies offering similar products or services but operating in distinct markets. The main objective is to broaden the market presence of the merged entity, enabling it to tap into new customer bases and enhance its market share.

Product Extension Merger

Product extension mergers occur when companies in the same industry combine forces to expand their product offerings. The products are often related but non-competing. For example, a soft drink company merging with a snacks company.

Stock Purchase Acquisition

Stock purchase involves acquisition of the shares of the target company.

Asset Purchase Acquisition

In case of asset purchase, the acquiring company buys specific assets of the target company (such as inventory, equipment, real estate).

GET IN TOUCH

Book your appointment with our legal specialists

Mergers and Acquisitions Process Steps

The M&A process involves multiple phases, each requiring legal, financial, and strategic planning.

Step 1: Strategy Development

At the beginning of any M&A transaction, setting clear goals and objectives is crucial. This process ensures clarity and alignment among stakeholders regarding the intended outcomes of the M&A deal, such as expanding market presence, achieving cost savings, or integrating new technologies.

Step 2: Target Identification & Research

Selecting the right M&A partner is crucial for driving corporate growth and strategic success. Developing a thorough set of criteria to identify suitable targets is essential, considering factors such as their financial stability, strategic alignment, and potential for adding value.

Step 3: Due Diligence

Due diligence involves a meticulous examination of the target company’s financial vitality, contractual commitments, operational efficiency, tax implications, and more. In the high-stakes world of mergers and acquisitions, due diligence is the game-changer that can make or break a deal. By uncovering potential risks and challenges, businesses can ensure their transactions are built on solid ground. Deals backed by thorough due diligence are far more likely to thrive.

Step 4: Deal Structuring & Negotiation

M&A success hinges on the details. Tailored legal agreements, such as Asset and Share Purchase Agreements, play a vital role in these complex transactions by addressing key elements such as the purchase price, payment terms, representations and warranties, and indemnities.

Step 5: Regulatory Compliance & Approval

M&A transactions in the UAE are subject to a complex regulatory environment that necessitates various approvals from different authorities. UAE has both free zone and mainland jurisdictions, each having its own legal and regulatory framework affecting M&A transactions. Successfully executing M&A transactions in the UAE demands a strong grasp of regulations in both free zones and mainland areas, alongside knowledge of diverse regulatory bodies’ specific requirements. Companies should maintain a diligent approach to guarantee compliance across all relevant jurisdictions.

Step 6: Deal Closing & Execution

To ensure a smooth transition, it is important to align the merged business with local laws, secure necessary approvals, update documents—setting the stage for a compliant and thriving entity.

Step 7: Post-Merger Integration

Once the deal is sealed, the integration journey starts. Addressing cultural and organizational hurdles is vital for successful mergers and acquisitions. Through comprehensive cultural evaluations, active leadership, employee engagement, and fostering open dialogue, organizations can manage these challenges, minimizing cultural mismatch risks while maximizing integration and synergy potential.

Legal guidance is essential at every stage to mitigate risks and streamline execution.

Our M&A Legal Services: What We Offer

Every deal is unique. We provide comprehensive legal support for every stage of your M&A deal.

Pre-transaction planning

We collaborate closely with clients to prepare Terms Sheet & Memorandum of Understanding (MoU) which summarizes the key terms and conditions for the proposed transaction. In preparing the term sheet, we focus on the confidentiality clauses and outline the necessary steps to finalize the transaction in order to proceed towards the execution of the Sale and Purchase Agreement . We also focus on issues such as exclusivity and security deposit that commonly arise in M&A transactions.

M&A Due Diligence

We perform meticulous due diligence to identify potential liabilities and risks, empowering our clients to make well-informed decisions. This includes a thorough review of the target company’s constitutional documents, employment documents, licenses and lease agreement, financial facilities taken by the target company etc. Our understanding of local UAE laws also helps us in identifying both ongoing and potential litigation involving the target company.

Contract Drafting & Negotiation

We offer expert advice on various transaction structures and engage in constructive negotiations. We provide comprehensive drafting services for a wide range of documents essential for M&A transactions such as Sale Purchase Agreements, Asset Purchase Agreements, Escrow Agreements etc. The preparation of SPA demands careful attention to detail and a thorough understanding of legal principles. We focus on several key aspects such as the purchase price, payment terms, representations and warranties, indemnities.

Regulatory Compliance

We manage DIFC, ADGM, and UAE free zone regulations for smooth approvals & guide clients through the complex regulatory environment in UAE, where both free zones and mainland areas operate under distinct legal frameworks. This requires a deep understanding of the diverse regulatory requirements across these jurisdictions. Our strong local presence, combined with extensive local knowledge and experience, enables us to navigate these complexities effectively

Post-Merger Integration & Restructuring

Once the deal is finalized, we support clients in developing post-merger integration strategies to facilitate a seamless transition and ensure alignment within the business as well as compliance with all local regulations. This includes liaising with the client for any NOCs required, reviewing relevant amendments to the constitutional documents, reviewing the assignment of lease agreement etc.

Get Expert Legal Advice on Mergers & Acquisitions with SK Legal

Mergers and acquisitions are complex transactions that require expert legal guidance to ensure compliance, risk management, and smooth integration. At SK Legal, we provide strategic M&A legal services tailored to your business needs.

FAQs: Answering Your M&A Concerns

Looking For Legal Advice in UAE?

Opening Hours

Monday-Friday

09:00 AM – 05:00 PM

Satuarday-Sunday

Closed

Office Address

Registered Address

SK Legal Consultants FZ LLC B4-212A6,

Business Centre 04

RAKEZ Business Zone-FZ Ras Al Khaimah