Mergers, acquisitions, and joint ventures are common strategies businesses use to grow, expand market reach, and gain a competitive edge. But they work in different ways. Mergers combine two companies by merging into a single entity. Acquisitions happen when a company acquires another company. Joint ventures (JVs) allow businesses to collaborate while remaining independent.

Mergers and Acquisitions (M&A) can drive efficiency, increase market share, and provide access to new technologies. On the other hand, joint ventures (JVs) enable companies to explore new opportunities, share risks, and pool resources without the full financial commitment of an acquisition.

For small and medium-sized businesses (SMBs), the right approach depends on their long-term strategic goals, financial investment, risk tolerance and how much control they want to keep.

Below, we break down the key differences to help SMBs determine the best path for their business, starting with mergers.

What is a Merger?

A Merger takes place when two companies join forces to create a new organisation. During this process, both companies legally dissolve their former identities and establish a new entity, usually under a different name.

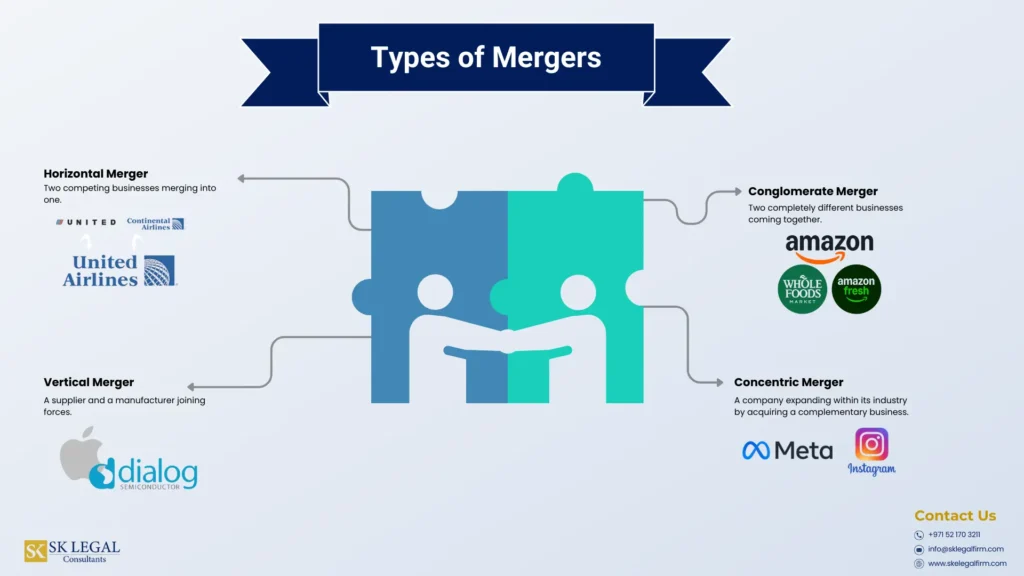

Types of Mergers

1. Horizontal Merger

A horizontal merger happens when two companies in the same industry and at the same stage of production merge. This type of merger reduces competition and increases market share. Horizontal transactions typically involve companies producing related products or providing similar services as direct competitors.

For example, the merger of United Airlines and Continental Airlines. Both companies were direct competitors in the airline industry, and their merger helped them expand their global reach and reduce operational costs.

2. Vertical Merger

A vertical merger occurs between companies operating at different stages of the supply chain. This type of merger helps improve efficiency, lower costs, and secure supply chains. Vertical transactions typically involve companies that are not in direct competition with one another. For example, a merger between a manufacturer and a distributor.

A well-known example of this type of merger is Apple acquiring Dialog Semiconductor. Apple used Dialog’s power management chips in its iPhones. By acquiring the supplier, Apple gained better control over production and reduced dependency on third-party suppliers.

3. Conglomerate Merger

A conglomerate merger happens when two companies from completely different industries merge. The main objective is diversification and reducing risk. This type of transaction also enables the newly formed company to broaden its portfolio and revenue streams.

For example, when Amazon acquired Whole Foods. Amazon, an e-commerce and cloud computing giant, acquired Whole Foods, a grocery chain, to enter the brick-and-mortar retail space and expand its presence in the food industry.

4. Concentric Merger

A concentric merger occurs when two companies in related industries but with different products or services merge. These businesses may share the same customer base, distribution channels, or technology but do not directly compete. The goal is to expand the product portfolio, improve market synergy, and enhance customer offerings. A notable example of this type of merger is Facebook (Meta) acquiring Instagram (2012).

Meta (formerly Facebook) acquired Instagram. While both operated in social media, Instagram focused on visual content, while Facebook was a broader networking platform. This merger allowed Meta to expand its digital ecosystem, attract younger users, and strengthen its dominance in the social media space.

Pros and Cons of Mergers for SMBs

Advantages of Mergers

Mergers offer a number of benefits:

- Increased market share by combining customer bases.

- Improved cost efficiency by eliminating redundant operations.

- Access to shared resources like technology and capital.

Disadvantages of Mergers

Despite its advantages, mergers involve substantial risks.

- Integration challenges can slow down progress.

- Clashing corporate cultures may cause friction.

- Legal and regulatory complexities can delay the process.

What is An Acquisition?

An acquisition, in contrast, refers to one company buying a controlling stake in another. In this scenario, the acquiring company assumes control over the target company’s operations, which may no longer operate as an independent entity.

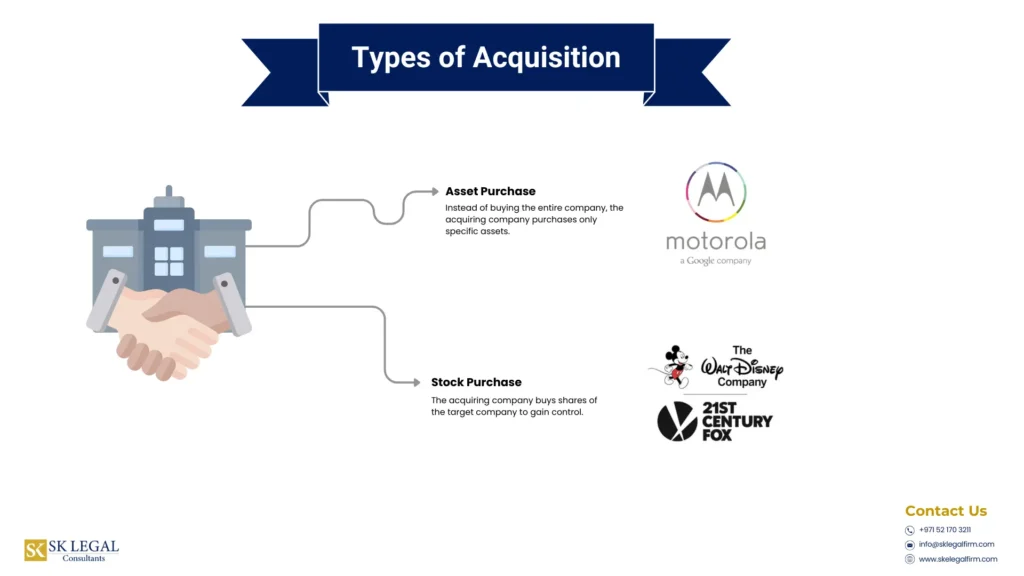

Types of Acquisitions

An acquisition can take two forms: Asset Purchase and Share Purchase.

Asset Purchase

Instead of buying the entire company, the acquiring company purchases only specific assets (such as patents, real estate, or product lines). For example, Google bought Motorola’s intellectual property in 2012 without taking over the entire company.

Share Purchase

The acquiring company buys shares of the target company to gain control. This could be through a majority stake purchase or a full buyout. For example, Disney purchased Fox’s shares in 2019 to take over its entertainment assets.

Pros and Cons of Acquisitions for SMBs

Advantages of Acquisition

Companies seeking a competitive edge often turn to acquisitions. Businesses can significantly strengthen their position by acquiring rivals and consolidating market presence.

Acquisitions also provide access to valuable assets like proprietary technology and specialised skills. Acquisitions can increase profitability, establish long-term market leadership, and give companies a competitive edge.

Disadvantages of Acquisition

While acquisitions are frequently used to boost growth and broaden market reach, they have considerable downsides. The significant expenses involved, from the initial purchase to the complexities of integration, is a major hurdle.

Another challenge is the potential loss of valuable employees due to uncertainty and cultural differences, which can disrupt productivity. Overcoming these challenges requires careful planning to realise the intended advantages of the acquisition.

What is a Joint Venture (JV)?

A joint venture involves two or more entities combining resources for a defined project or goal. The companies share profits and losses but each retains its separate identity. These ventures are often short-term collaborations aimed at objectives such as market entry or risk diversification. Mergers and acquisitions, on the other hand, create a single, unified company that is appropriate for long-term integration.

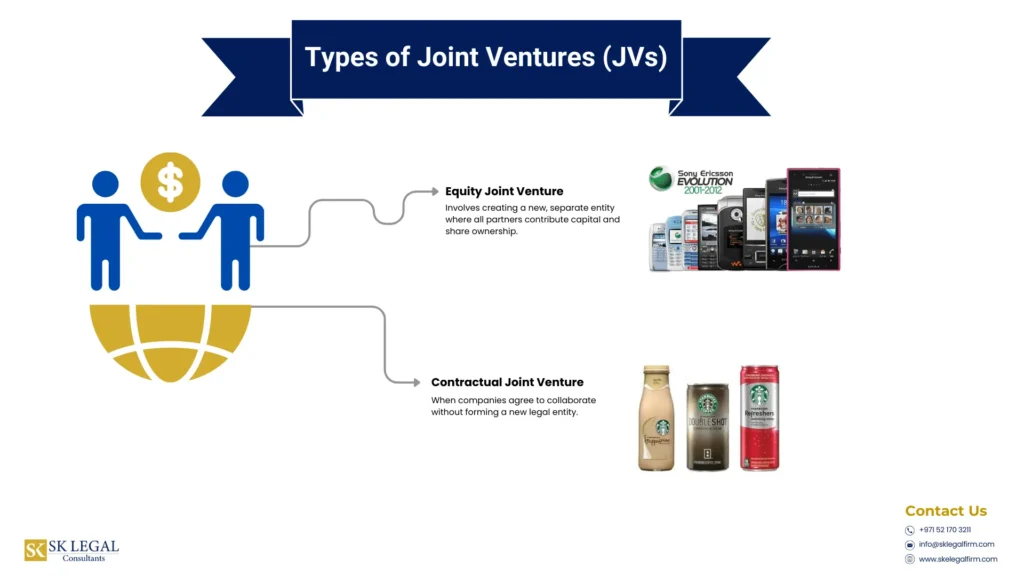

Types of Joint Ventures (JVs)

Joint ventures (JVs) allow businesses to collaborate while remaining independent. They can be structured in different ways based on ownership, purpose, and legal setup. Here are the main types:

Equity Joint Venture

An equity joint venture involves creating a new, separate entity where all partners contribute capital and share ownership. Profits, losses, and decision-making are distributed based on equity stakes.

For example, Sony and Ericsson (2001-2012) formed a joint venture to produce mobile phones, combining Sony’s tech expertise with Ericsson’s telecom infrastructure.

Contractual Joint Venture (Non-Equity JV)

In a contractual joint venture, companies agree to collaborate without forming a new legal entity. Each partner remains independent but shares responsibilities, resources, and profits based on a contract.

For example, Starbucks partnered with PepsiCo to distribute bottled coffee drinks worldwide, leveraging Pepsi’s distribution network without forming a new company.

Pros and Cons of Joint Ventures for SMBs

Benefits of Joint Ventures (JVs)

Joint ventures create mutually beneficial partnerships. By distributing risk and pooling capital, firms can engage in projects that would otherwise be financially or strategically untenable. Joint ventures offer a strategic advantage for entering new markets, allowing companies to tap into each other’s networks and local knowledge for faster, more efficient growth.

Furthermore, joint ventures provide a degree of flexibility, as they are often short-term agreements that dissolve upon project completion, allowing each entity to retain its identity and revert to standard operations afterwards.

Disadvantages of Joint Ventures (JVs)

While joint ventures (JVs) can be beneficial, they also pose significant challenges. Shared decision-making can be complex, causing delays and conflicts. Disagreements over profit distribution, particularly when contributions vary, can lead to dissatisfaction.

The failure to establish a clear exit strategy can create substantial problems, including disputes and financial losses, should a partner seek to withdraw. Conflicting goals among partners, such as differing investment timelines, can also stall progress.

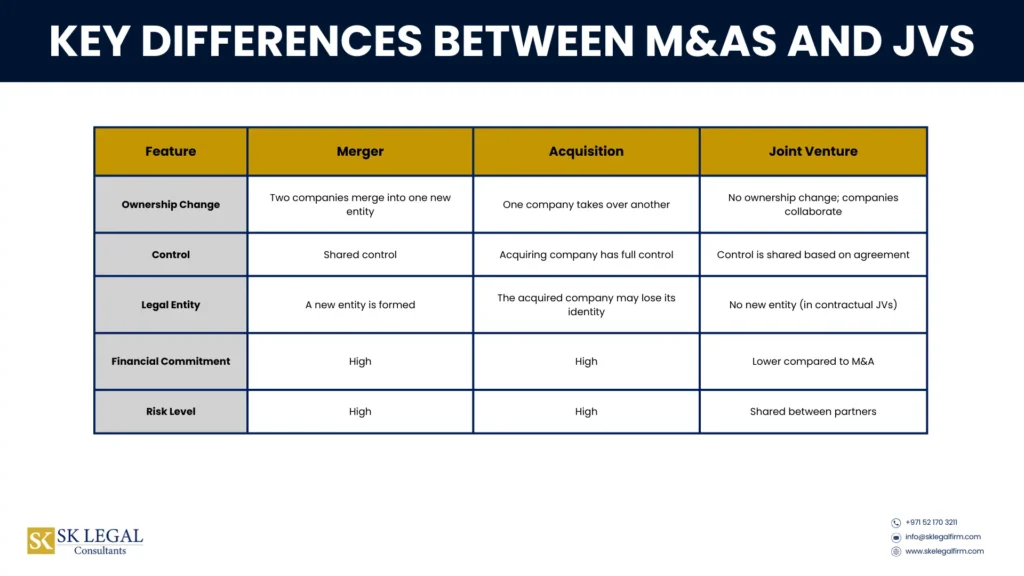

Key Differences Between Mergers, Acquisitions, and Joint Ventures

Ownership and Control Comparison

Acquisitions often involve one company absorbing another, while mergers create a brand-new entity. In the case of an acquisition deal, the acquiring company assumes full ownership and control of the target company.

The target then typically ceases to operate independently as its assets and operations are integrated into the acquirer. The acquirer then has the authority to make all key decisions, resulting in major changes to the organisation’s management and operations.

In contrast, a joint venture brings together two or more companies who agree to cooperate while remaining distinct entities. Each company retains ownership of its original assets and shares control of the joint venture based on the agreed-upon terms. This ensures decisions are made collectively, but individual companies still maintain a degree of autonomy.

Financial and Legal Considerations

Mergers and acquisitions usually require significant financial investments due to the capital needed to acquire assets or shares. The legal aspects are complex, demanding thorough due diligence and regulatory compliance. Joint ventures typically need less initial capital than M&A, making them a more viable option for SMBs.

Risk Distribution and Business Impact

In an acquisition deal, the acquiring company takes on all the risks linked to the target company, which encompasses operational, financial, and reputational challenges. The acquiring firm will face all resulting negative impacts if the acquisition fails to deliver the anticipated advantages.

In a joint venture, risks are distributed among partners based on their ownership percentages or contractual terms. This collaborative approach can lessen individual risk exposure but requires strong teamwork and open communication to effectively address any potential conflicts or challenges that may arise throughout the partnership.

Which Option is Best for SMBs?

- If you want full control and long-term growth, an acquisition might be the best option.

- If you prefer collaboration with lower risk, a joint venture is a better choice.

- If you’re looking to expand market share with a similar company, a merger could work well.

Conclusion

Mergers, acquisitions, and joint ventures all offer opportunities for business growth, but they serve different purposes. Mergers and acquisitions lead to full integration, giving businesses greater control and market influence, while joint ventures provide a collaborative approach with shared risks and resources.

For SMBs, the right choice depends on strategic goals, financial capacity, and the level of control they wish to maintain. A well-planned acquisition or merger can strengthen market position and streamline operations, whereas a joint venture offers flexibility and a lower financial commitment.

Regardless of the approach, careful evaluation, legal due diligence, and expert consultation are essential to ensure long-term success. Making an informed decision can help businesses expand efficiently and sustain growth in a competitive market.

Get Expert Legal Advice on Mergers, Acquisitions, and Joint Ventures with SK Legal

Expanding your business through a merger, acquisition, or joint venture requires careful planning and legal precision. At SK Legal, we provide expert guidance to help SMBs handle complex transactions with confidence.

- Comprehensive Legal Consultancy: Expert advice on mergers, acquisitions, and joint ventures.

- Due Diligence & Compliance: Ensuring smooth transactions and regulatory compliance.

- Strategic Business Structuring: Helping SMBs choose the right partnership or expansion model.

For personalised legal guidance, contact us at [email protected]

Frequently Asked Questions (FAQs) about Mergers, Acquisitions, and Joint Ventures for SMBs

A merger combines two businesses into one, an acquisition occurs when one company buys another, and a joint venture is a temporary collaboration where both companies remain independent.

It depends on business goals. Mergers work well for businesses looking to consolidate, acquisitions suit companies wanting full control, and joint ventures are ideal for temporary collaborations with shared risks.

SMBs must consider contractual obligations, regulatory approvals, tax implications, employee rights, and competition laws before engaging in M&A deals.

Joint ventures allow SMBs to share costs, access new markets, gain expertise, and reduce risks without giving up full control of their business.

Potential risks include financial losses, cultural clashes, operational disruptions, and regulatory hurdles if proper due diligence isn’t conducted.

M&A deals typically take 6 months to 2 years, while joint ventures can be structured in a few months, depending on complexity and regulatory requirements.

Yes, if the joint venture proves successful, the companies may choose to merge, or one may acquire the other, turning it into a permanent business relationship.

- Merger: Exxon and Mobil forming ExxonMobil.

- Acquisition: Facebook acquiring Instagram.

- Joint Venture: Sony Ericsson before Sony acquired full ownership.

Yes, legal expertise is crucial for contract drafting, compliance, due diligence, and ensuring the deal benefits all parties involved.

Mergers and acquisitions (M&A) primarily refer to the buying, selling, or combining of companies. M&A does not include joint ventures.

A merger occurs when two companies combine to form a single entity, often as equal partners. In contrast, an acquisition happens when one company purchases another, gaining full control while the acquired company may retain its brand or be absorbed entirely.

A joint venture differs from a merger because it does not involve the permanent joining of two companies. Instead, the two companies sign a joint venture agreement for a specific project or goal while remaining independent. In a merger, companies fully integrate into one business entity.

- Legal Structure: A joint venture is a temporary collaboration for a specific purpose, whereas a partnership is a long-term business entity.

- Ownership: In a joint venture, partners retain their independent businesses, while in a partnership, all assets and liabilities are shared.

- Duration: Joint ventures typically dissolve after completing a project, whereas partnerships continue indefinitely unless dissolved by agreement.

Disclaimer

This publication does not provide any legal advice and it is for information purposes only. You should not rely upon the material or information in this publication as a basis for making any business, legal or other decisions. Therefore, any reliance on such material is strictly at your own risk.

Share This Post On: